From Suez to the Supermarket: A Story of Currency Collapse?

Instead of keeping all your savings in dollars, it could be prudent to diversify at this time due to the diminished purchasing power.

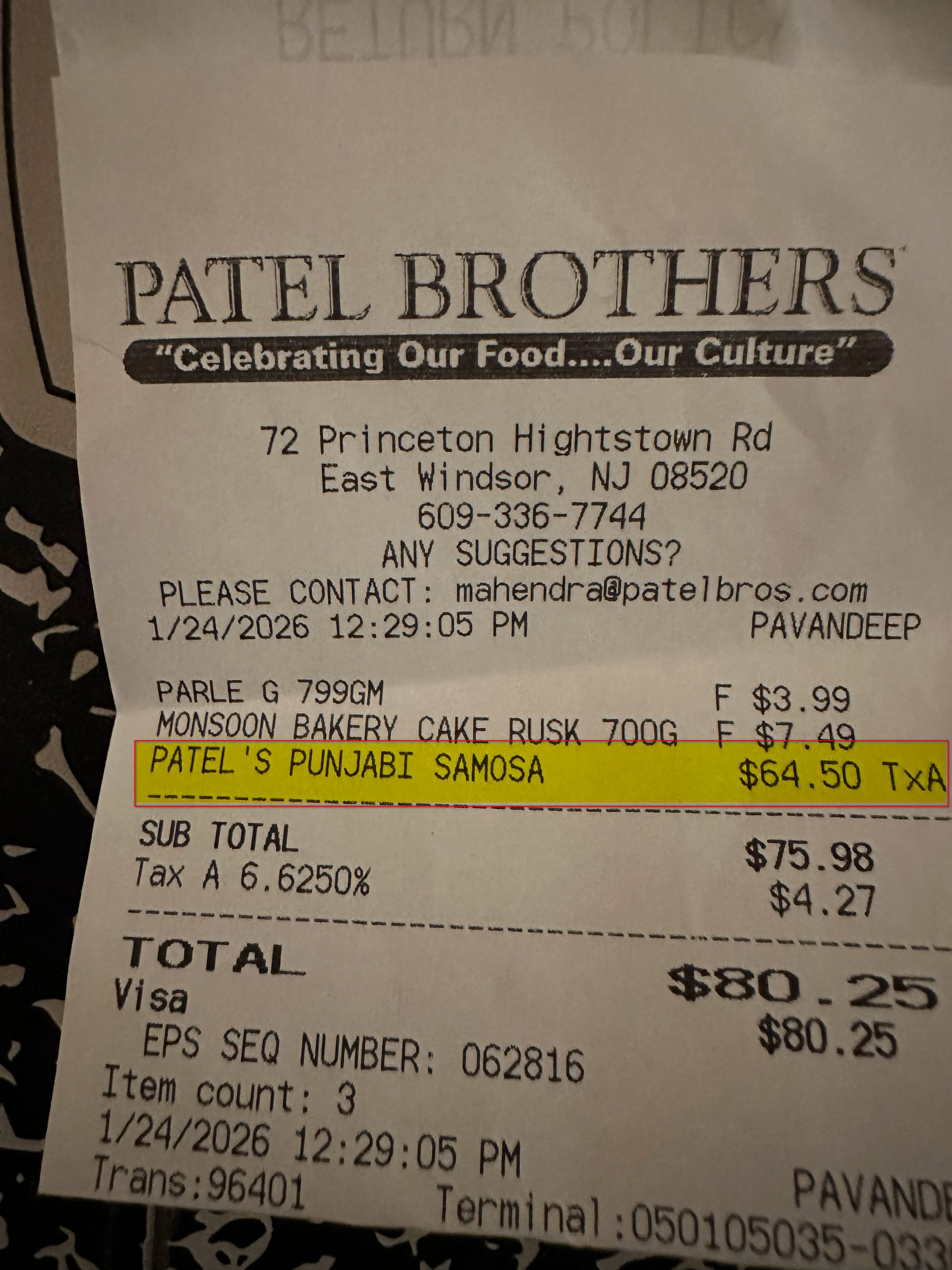

Yesterday, I stopped by Patel Brothers to pick up a tray of 50 Punjabi samosas for a gathering. For as long as I can remember—at least a decade—these samosas were a reliable $1 apiece. But when I got to the register, the total for that tray was $64.50. That is a $15 jump, or roughly a 30% increase, seemingly overnight!

A Journey of Discovery: History’s Warning Signs

To understand where we are going, we have to take a Journey of Discovery into the past. The video below suggests that history provides a blueprint for what happens when a global reserve currency loses its "exorbitant privilege".

The significance of the Samosa price increase scared me after I saw this video.

The British Pound’s Cautionary Tale

The decline of the British Pound serves as a stark "Before-After-Bridge" for the modern dollar:

- The 7-Day Collapse: In 1956, during the Suez Crisis, the British Pound lost its global dominance in just one week after a US threat to sell its holdings.

- The Debt Trap: Britain shifted from the world’s largest creditor to a major debtor by borrowing heavily for WWI and WWII.

- The Illusion of Prosperity: For years, Britain used financial engineering and money printing to maintain a facade of wealth, even as inflation simmered beneath the surface.

- The Soft Default: By 1967, the pound was devalued by 14%—a "soft default" that directly slashed the purchasing power of every citizen.

The US in 2026: A Mirror Image

We are currently seeing a mirror image of these historical parallels:

- Mounting Debt: US national debt has now exceeded $38 trillion.

- Budget Strain: Interest payments on that debt have surpassed the national defense budget.

- Alternative Searching: The "weaponization" of the dollar has accelerated a global search for alternatives, such as gold and BRICS currencies.

The "Nightmare Scenario" isn't a sudden war; it’s a failed Treasury auction where buyers simply don’t show up. This would force the Federal Reserve to print trillions to monetize the debt, leading to runaway inflation that could destroy the value of your savings.

What’s In It for You?

Although my father was a historian, I have never really paid attention to history. However, these days I'm realizing that was a mistake because there are very valuable lessons that can be learned from the past. The takeaway for me was this:

Instead of keeping ALL my savings in dollars, it is prudent to diversify due to the risk of the dollar's diminished purchasing power.

I am obviously not a financial advisor, and this is not financial advice for you. I'm merely sharing my own thoughts on investing and how they evolve based on new information that crosses my path.