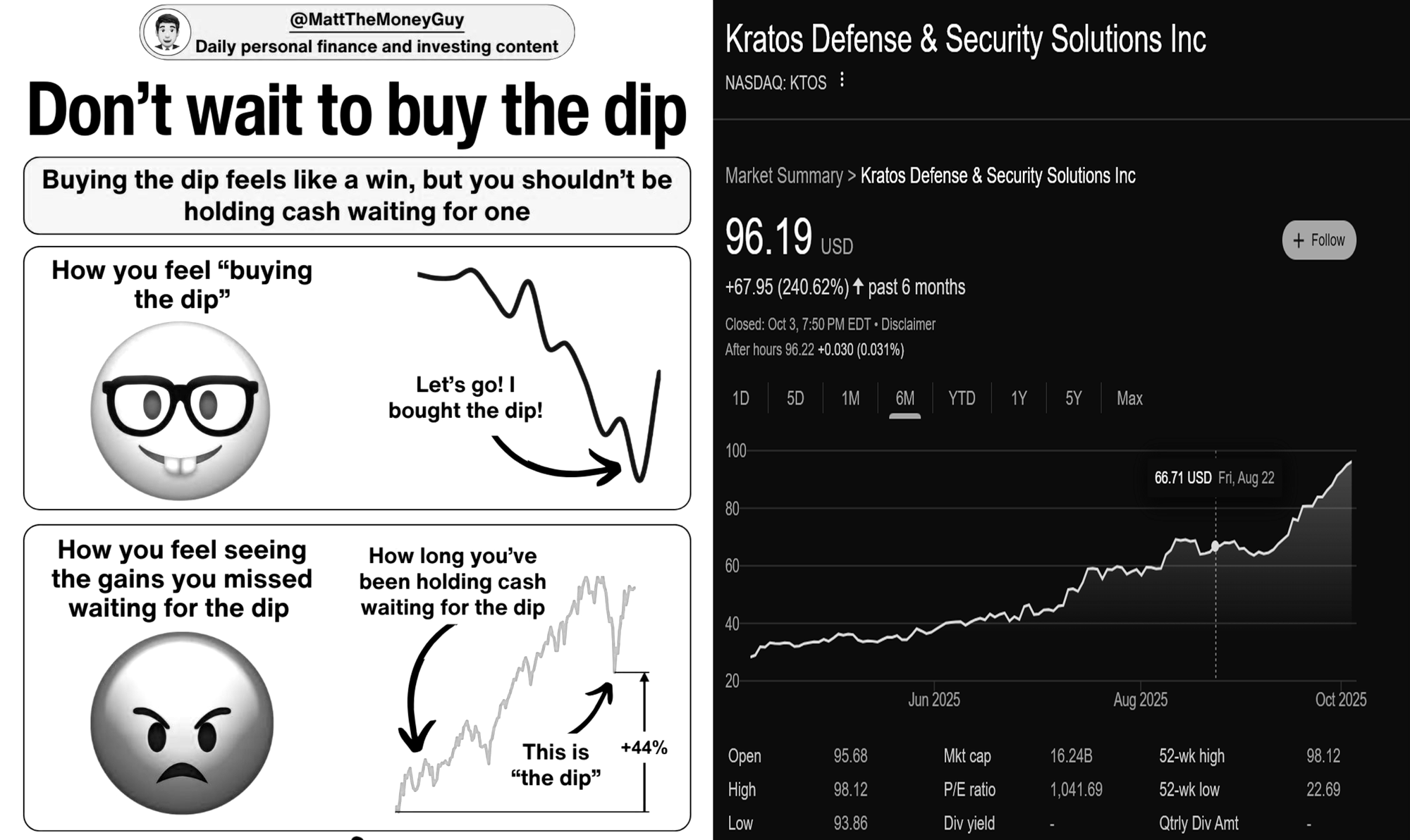

Investing: Don't wait to buy the dip

Sunday morning, coffee in hand, I'm watching CBS Sunday Morning which featured a segment on AI, when they show footage of the US exploring AI for drones for the Air Force.

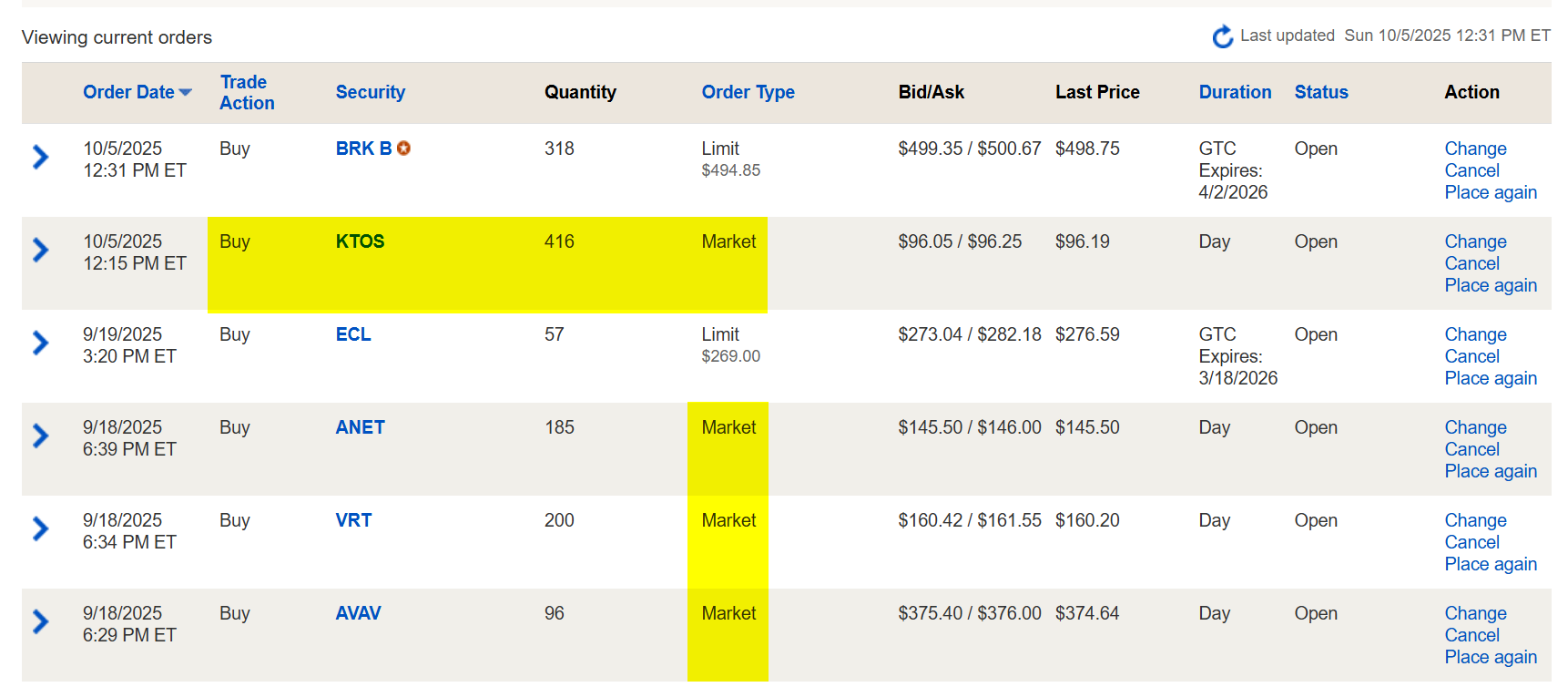

One company name on the tail of the aircraft caught my attention: Kratos.

I'd heard of them before. In fact, I'd set up limit orders on drone stocks, waiting patiently for the price to drop to my target. I was being disciplined, waiting for the dip like a smart investor.

Then I checked the current stock price.

My stomach dropped faster than any imaginary dip I'd been waiting for. Kratos had appreciated significantly over the past six months - 240%!. While I sat there with my clever limit orders, the stock had been climbing without me.

Matt The Money Guy's advice hit me like a drone strike: sometimes you need to buy.

I'd fallen into the classic trap. I had reservations about investing in defense stocks—drones can hurt people, after all. I'd rather put my money into green energy. For drones, I'd much rather if the world shared positive news like the drone show at the vatican that my sister told me about. But watching AI transform everything and seeing how defense stocks have been performing, I realized I was letting perfection become the enemy of good.

So I did something different than what I've ever done in the past. I changed several of my limit orders to market orders. When the markets open Monday, those stocks I'd been waiting to bargain-hunt will automatically trigger at whatever the market price is.

No more waiting for the perfect entry point that might never come.

Here's what I'm learning: the opportunity cost of waiting can exceed the cost of buying at a slightly higher price. Yes, you might pay a bit more today. But if the stock continues climbing while you wait for your perfect price, you've lost far more than you saved.

The Kratos situation showed me I'd been thinking about risk all wrong. I thought I was being cautious by waiting. But I was actually taking on a different kind of risk—the risk of being left behind entirely.

Another news article that made me want to invest in the boom of data centers was an article by NVIDIA CEO Jensen Huang who said electrical and HVAC folks are going to be highly in demand and earning $100,000 salaries without a college degree.

This doesn't mean throwing discipline out the window and chasing every stock that's running up. It means recognizing when your hesitation is costing you real opportunities.

I'm still being selective. I'm still doing some research. But I'm no longer confusing patience with paralysis.

Sometimes the dip you're waiting for is the current price.

What investing lessons have you learned the hard way? Hit reply and tell me about a time when waiting cost you more than buying would have.