My investing philosophy and lessons learned

I missed out on 20K and that's 0K

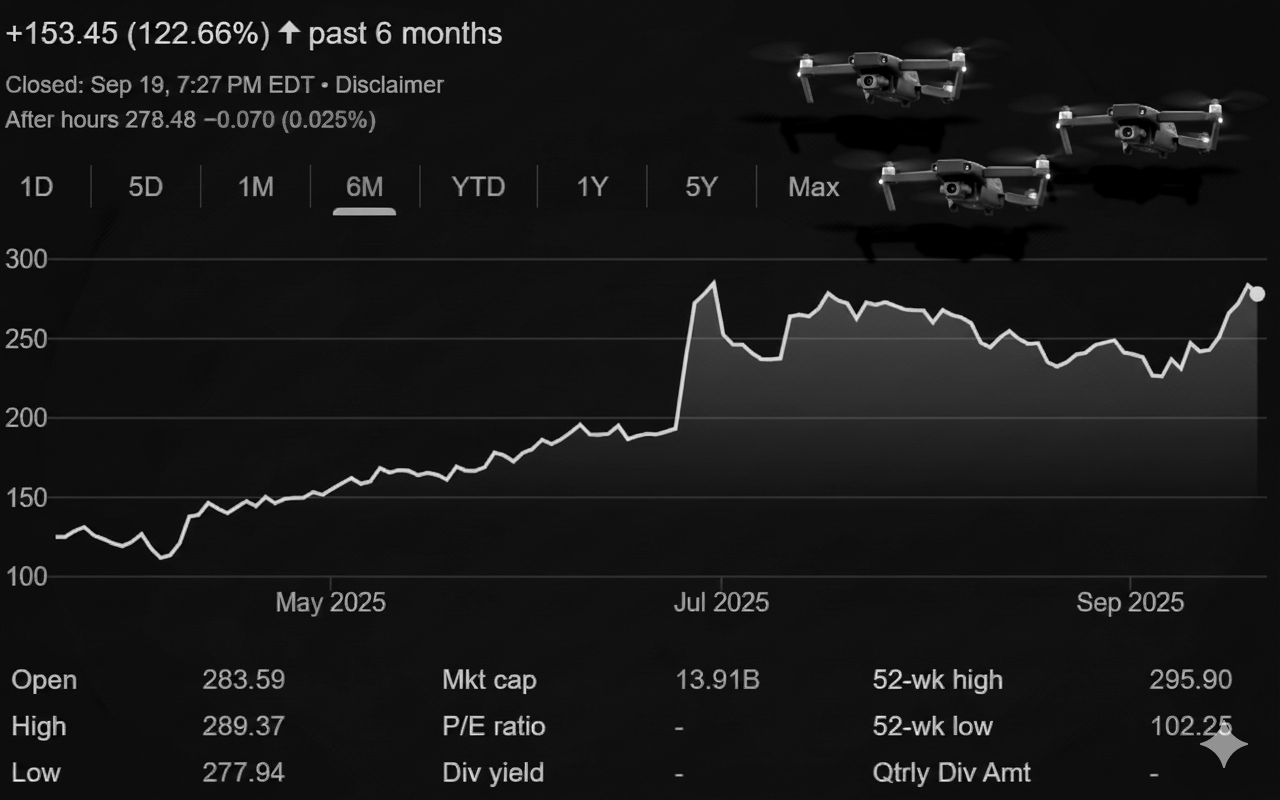

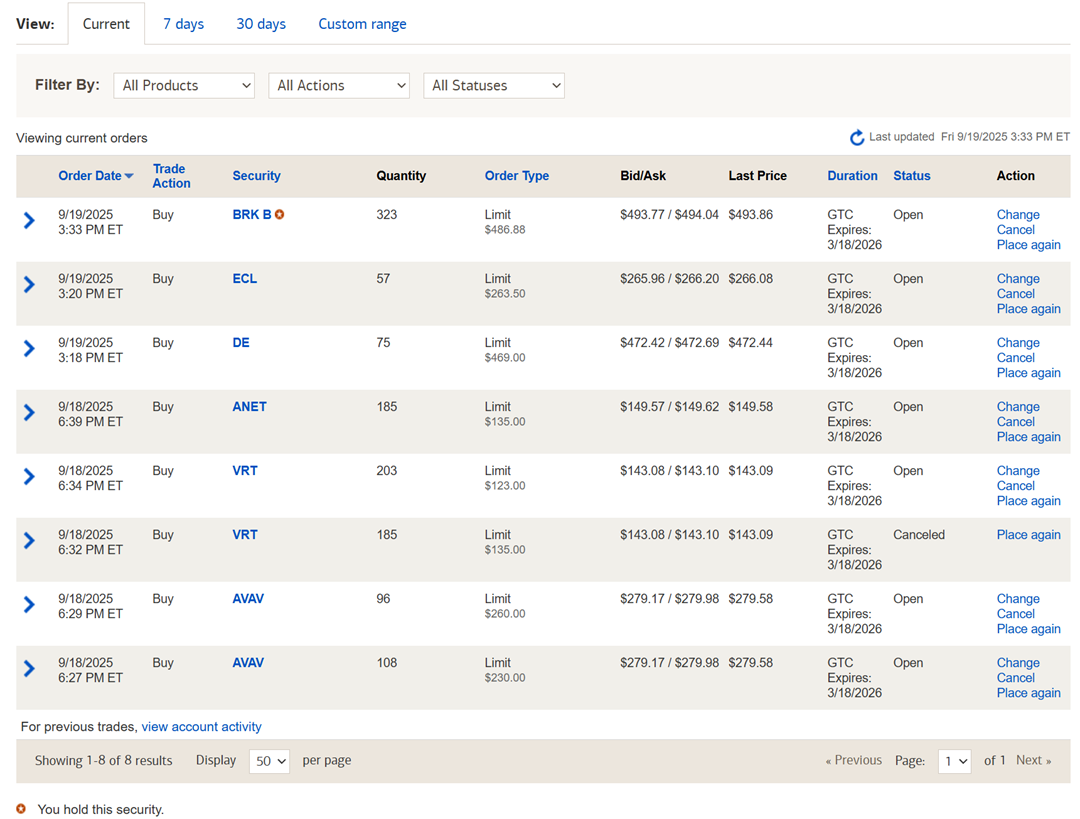

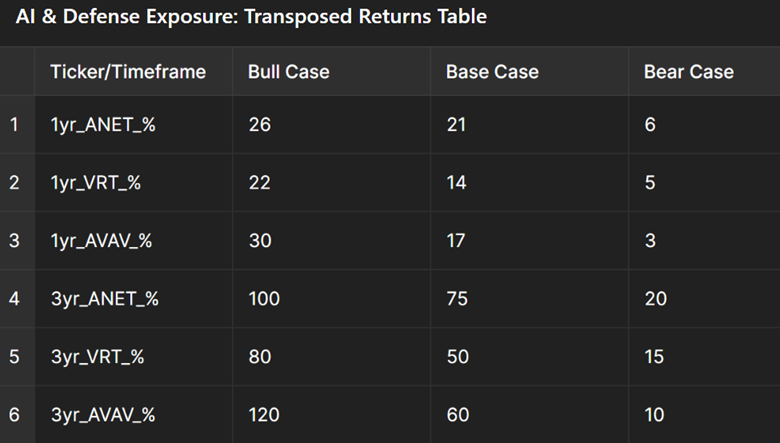

Three months ago I decided to invest in defence sector stocks. I used ChatGPT to research three drone companies, study their price ranges, and place limit orders totaling $50,000. But then I noticed the prices climb. And climb. Geopolitical events—Ukraine, Israel, and the India-Pakistan conflict—drove up demand. In two months, those 3 stocks I wanted to buy rose up 40%. A $50,000 investment could have made me $20,000 in just 2 months, but I didn't get a single cent because of my limit order strategy. Was it greed? Well, yes.

Conservative discipline? I rationalize yes, because I still continue to place new buy orders based on the same concept of "Limit" orders (buying the dip) leaving some margin of safety.

30 Years of Real Trades and Real Lessons

I've been investing aggressively in stocks (equities) for over three decades, maxing out my 401k from day one. In my fifties, I got the opportunity to convert from the limited safe stocks in my 401k into an IRA, which gave me more flexibility in choosing the stocks I want. Since last year I've started moving money out of my 401K & Regular IRA Retirement accounts where the growth is taxable into a Roth IRA where it can grow tax free.

My investment ideas come from conversations with a colleague at work much more intelligent than me, from YouTube channels like Ticker Symbol You or investors like Monish Pobrai who currently recommends BRK.B over S&P 500.

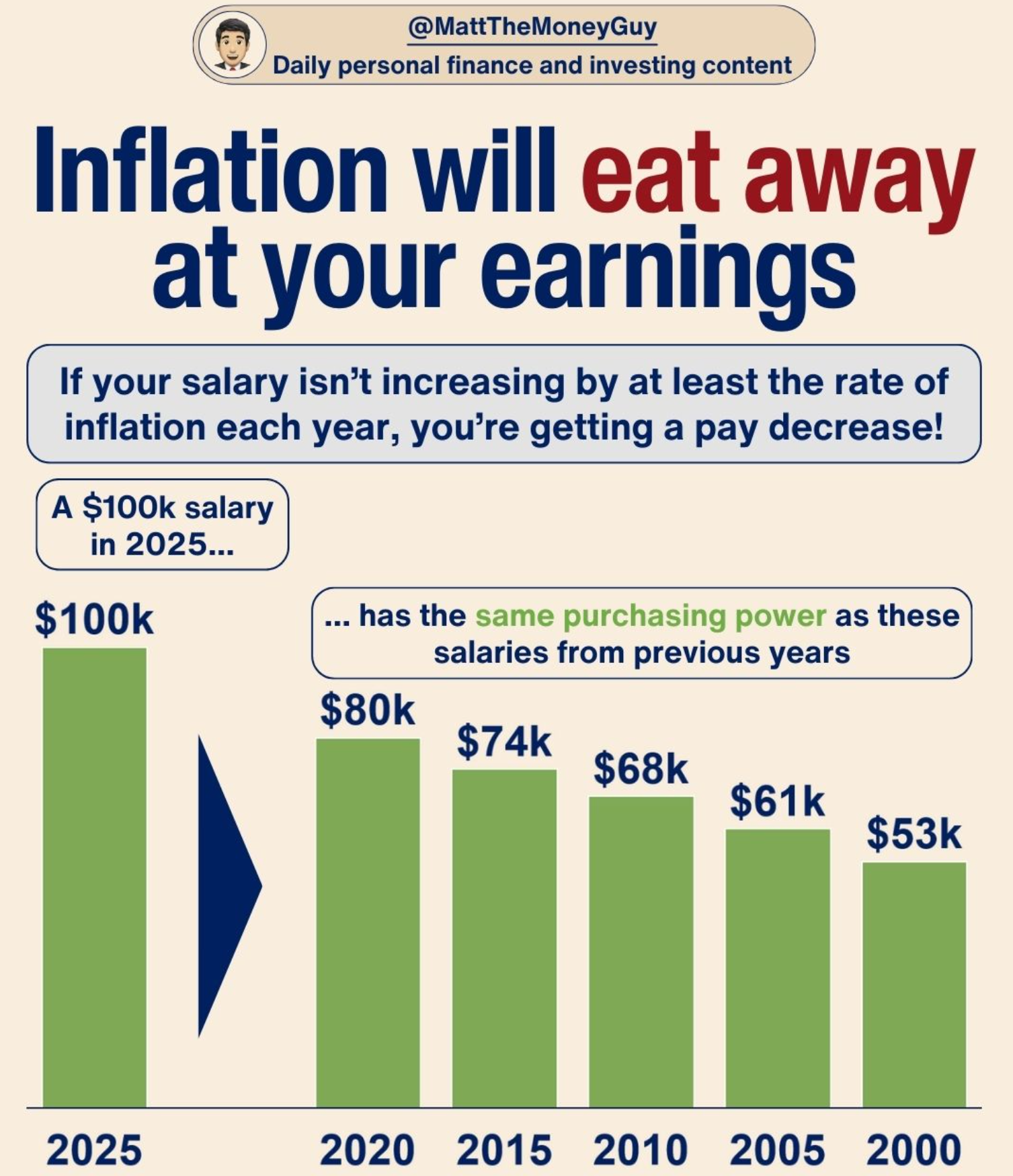

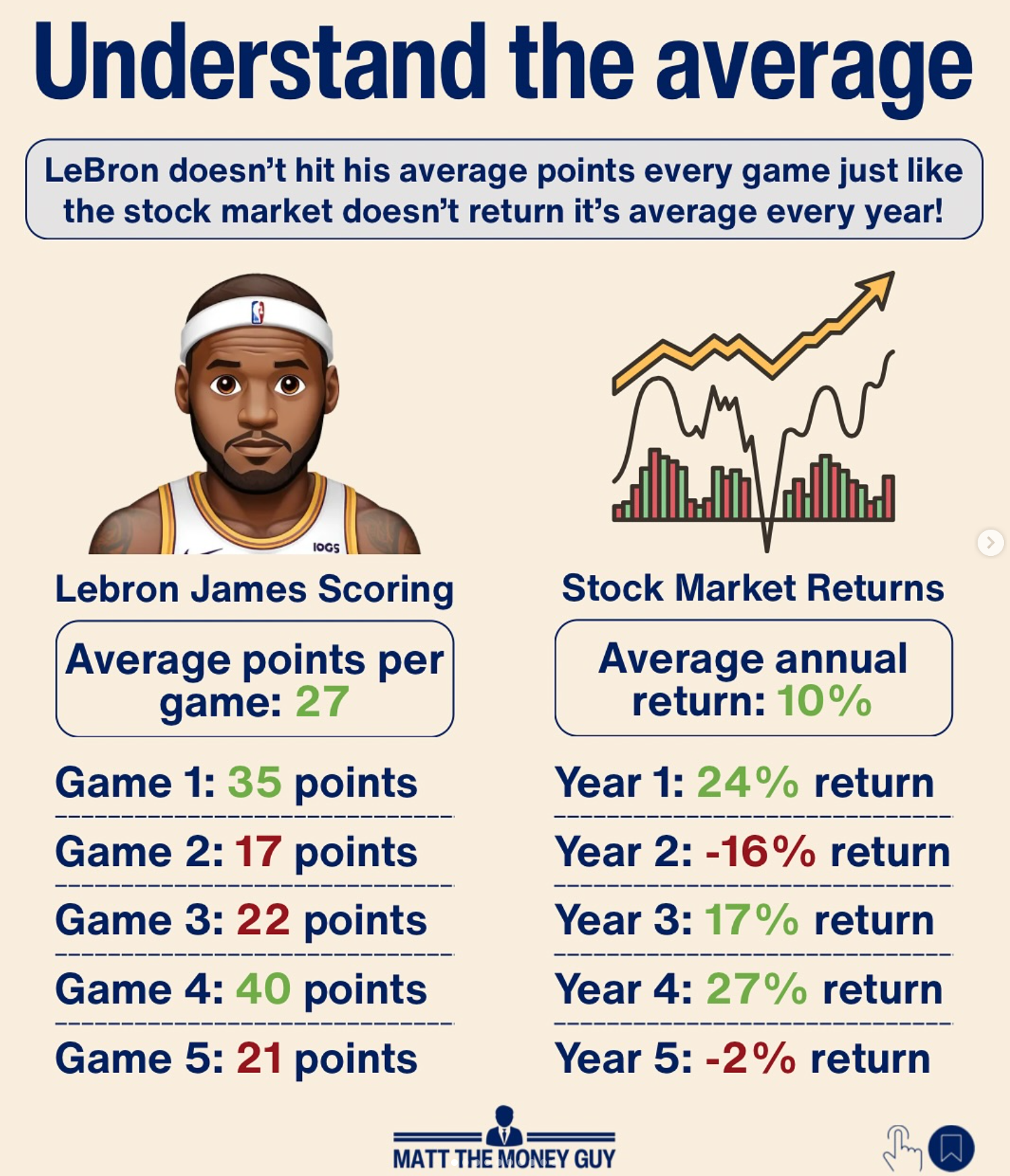

Some people, like my wife Eileen prefer to keep savings in safe assets, like CD's at the bank. These currently yield ~4% return, but are expected to yield lower due to the Fed rate cuts. Other people advise putting a larger portion of funds into bonds, or target date age-adjusted plans when they are over 50 years. With all the "money printing" , tariffs, the debt clock, increase in crypto etc. I'm personally more afraid of Inflation and am still concentrated in stocks, striving for an average 10% growth year over year.

Click thumbnails below to see larger images.

The best trade in my entire life was buying Nvidia in 2017 — where my money multiplied over 40 times. That's over 4000% return. It was pure luck, nothing astute or insightful in my market research.

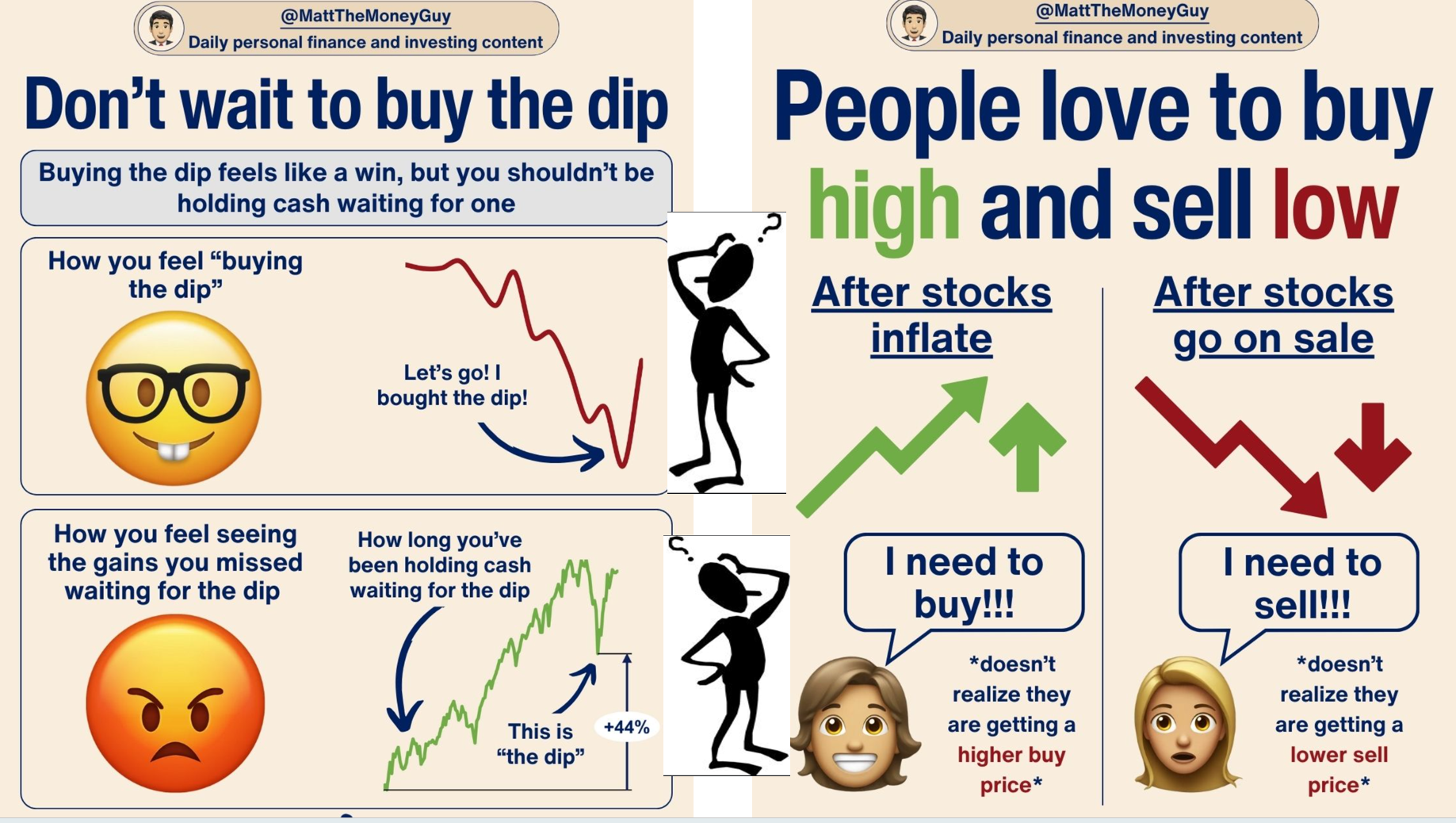

I believe there is absolutely no way for us to predict which way individual stocks will move in the short term. It is more important to be invested with time in the market rather than try timing the market.

Amazon also did very well, and that came from a simple philosophy: invest in stocks you personally love. I'd been happy with Amazon's service for years. They ship to your door, the convenience factor is incredible, and returns are a breeze. So I bought the stock and held it for the length of time needed to see real gains. My Amazon purchase was based on the concept that you invest in products and services you personally use and believe in.

However this philosophy of buying stocks in products you love does not always work out. I invested $40,000 in Alteryx, a software I use at work and initially thought of it as "the best thing since sliced bread". Unfortunately it did not rise up that much during the time that I held it (I think because of its very high licensing costs) and finally, I decided to sell it.

I also lost $25K dabbling in options trading. I decided that puts, calls, and day trading weren't for me. Losses taught me to stick with what I knew and understood.

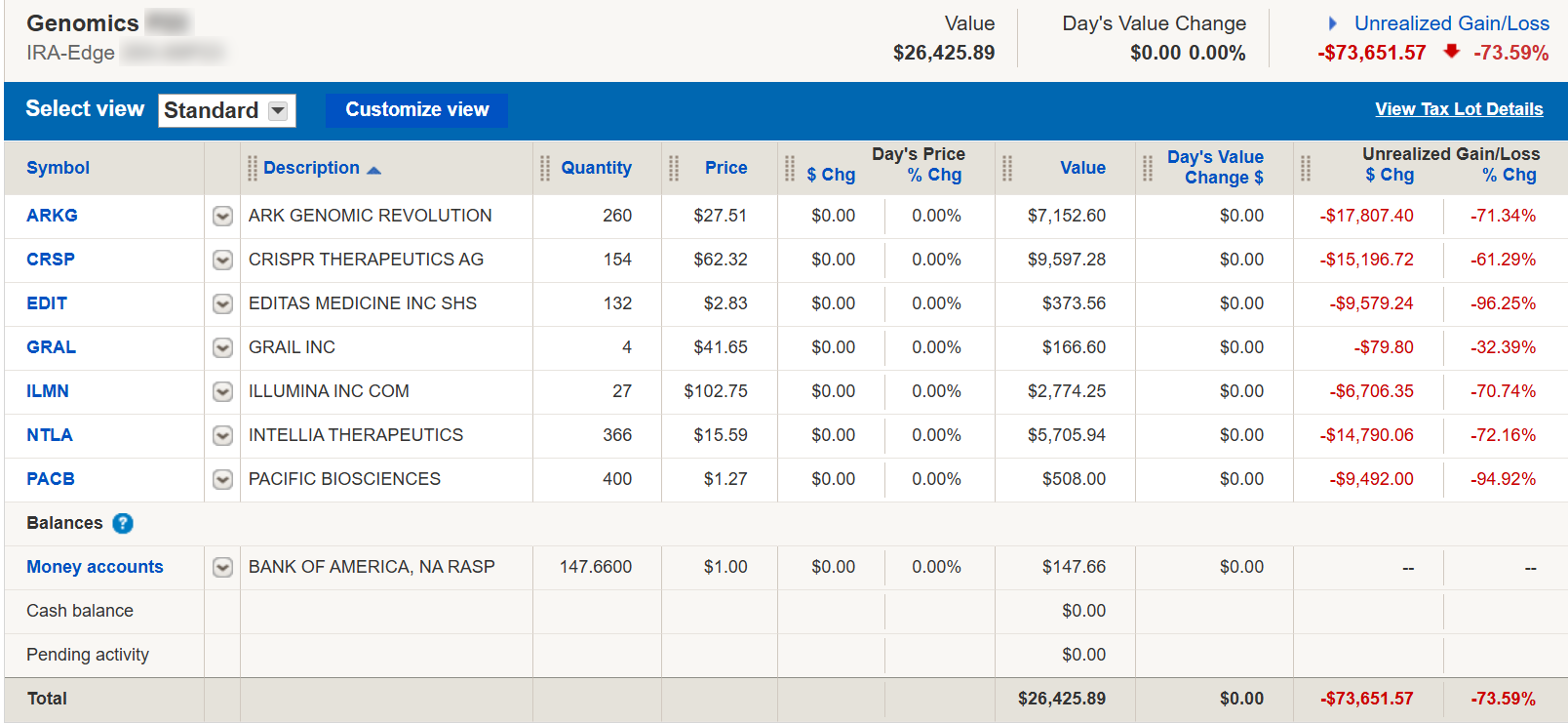

Of course, I've bet on sectors that have not performed well. I'm not selling these at a loss, just in case even one of these stocks bounces back (perhaps due to AI advances).

My Buy and Hold Philosophy

My general investing philosophy is buy and hold. I don't buy on FOMO—fear of missing out. Instead, I look at prices within the last month and try to pick up stocks near a low of that range, then place a limit order. This is where I leave myself a margin of safety. I know stocks fluctuate up and down regularly. and I want to take advantage of a slight dip when I buy. The profit you make depends on your purchase price.

I've already shared a post about some books that shaped my money philosophy. I see my portfolio not as a scorecard but as a tool for enjoying my pre-retirement life, and supporting other creators. My aggressive investment strategy enables me to take risks and also makes possible the luxury of time—the most valuable currency of all.

A Personal Invitation

These reflections come from real trades, real wins, and real losses. I send weekly insights like this—connecting money, creativity, and the lessons learned from both successes and failures.

If you're interested in more reflections on money, creativity, etc. let me know what resonates. These conversations and feedback I receive via the poll I sent to my subscribers shape what I write next.